ABOUT ME

My name is Hang “Hailee” Dang, a senior majoring in Data Science with interest in Finance and Data and Business Analytics.

MY PROJECT

Abstract

The philosophy of value investing was first introduced by Benjamin Graham in 1934. His publication on investing brought a new structure and logic to the field and then created a framework for investing. Warren Buffet is the person who then helps refine and enlarge these principles. Value investing is merely a choice of strategy for people to follow and react to financial storms, therefore, my question is whether there should be an adjustment or adaptation to the conditions at hand so that this approach of investing can be more applicable to the development of nowadays financial markets.

Goals and Obstables

This paper aims to find a new metric besides some fundamental metrics that have been primarily used in value investing strategy. Research objects are chosen from the list S&P100 since the data needs to be completed in order to be able to generate desired results. Any applications outside this data frame would not be reflected correctly.. The time period is in 2017 to 2021 range since some data is missing or has not been recorded on Alpha Vantage system for the few previous fiscal year. The paper explains reason of choosing the 5 fundamental metrics using existing papers and studies. Then, using data from online financial database system with R to evaluating the correlation between these metrics and the actual performance over a 10-year period. The result will diverse from least to most correlated to the actual stock performance. New highly correlated metric such as media mentions or number of articles about the company should be added to the model to increase the correctness of the prediction. This theoretical model only applies to the time range from 2011-2021 and profited large corporations in technology industry.

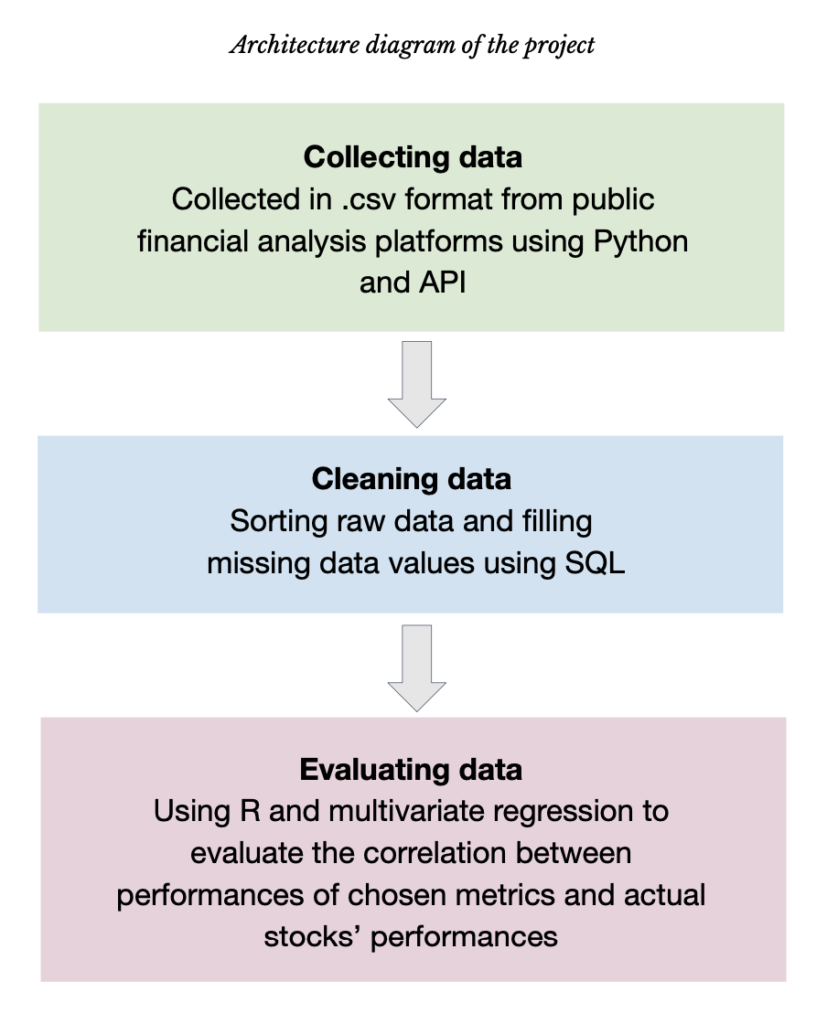

Architecture diagram