ABSTRACT

There has been a lot of attempts in building predictive models that

can correctly predict the stock price. However, most of these models

only focus on different in-market factors such as the prices of other

similar stocks. This paper discusses the efficiency/accuracy

of three different neural network models (feedforward, recurrent,

and convolutional) in predicting stock prices based on external

dependencies such as oil price, weather indexes, etc.

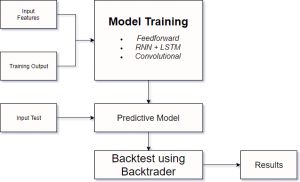

Software architecture

Links:

Leave a Reply

You must be logged in to post a comment.