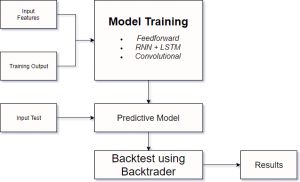

Examine different neural networks’ efficiency in predicting stock prices

ABSTRACT

There has been a lot of attempts in building predictive models that

can correctly predict the stock price. However, most of these models

only focus on different in-market factors such as the prices of other

similar stocks. This paper discusses the efficiency/accuracy

of three different neural network models (feedforward, recurrent,

and convolutional) in predicting stock prices based on external

dependencies such as oil price, weather indexes, etc.

Software architecture

Links:

Survey Paper – v1.0

My full survey paper can be found using the following link. Please keep in mind that there has been some changes to it since CS388 ended. The changes would be reflected in the actual paper.

Survey Paper

Week 1 (3/29):

- I have found a reasonable amount of papers to read.

- I have refined the topic. The previous topic was about analyzing and find the relationship between weather pattern and oil stock price. I have decided to broaden the topic to find the relationship between two general entities (so not just weather pattern and oil stock price) by developing an algorithm for similarity scoring and matching.

- I have a basic outline for the survey paper jotted down.

Week 2 (4/5):

- A lot of readings, especially about SVM (Support Vector Machine)

- Work on adding some more text in the introduction part

- Read, read, and read.

- Explore the term artificial neural networks, etc.

Week 3 (4/12):

- Read about different approach to pattern matching problem in other area of study (BLAST, etc.)

- Read about AI neural networks, it’s confusing.

- Start adding meat to the outline of the survey paper.

Week 4 (4/19):

- Watch the MIT’s Opencourseware Intro to AI

- Modular Neural Network – Reading

- SVM readings

Week 5 (4/26):

- Continue the course

- Re-learn calculus

Annotated Bibliographies

Capstone Abstracts – v1

I/ Sometimes lectures and text books can be too “dry” for students to get excited about a subject, specifically economics. At the same time, researchers have found the potential of games in education, especially when used as an introduction to new concepts. EconBuild is a game that simulates different aspects of economics that we normally encounter in our economics intro classes, proving students a platform to practice what they learn in class. The game can help students to enforce the most fundamental elements of economics such as demand and supply, stock market, etc.

II/ In this day and age, more and more businesses choose to expand their brand using social networks, thus leading to the fact that social media users continue to provide advertisement, positive and negative. In order to become competitive, it is necessary for a company to establish its online present as well as analyze its component’s dominance. Using a Hadoop based approach to reduce the size of database, we can gather and analyze information about a company on social media and predict certain trends to help with its growth.

III/ Stock market is usually unpredictable. There is no particular rule that it obeys to, which is why investing in stock is considered a risky business. Many people have tried to analyze particular trends in order to guess whether the stock price would rise or not. However there hasn’t been a lot of software that analyze the relationship between different related stocks. Using support vector machine approach, combining with graph similarity scoring and matching algorithm, we can establish relationships between different stocks, thus open the possibility of being able to predict particular stock trends.

Hello, World

Hello World