CS488: Senior Capstone Project

-Muskan Uprety

Keywords

Stock Prediction, Sentiment Analysis, Stock Price Direction, Social Media Sentiment

1. Abstract

Due to the current pandemic of the COVID-19, all the current models for investment strategies that were used to predict prices could become obsolete as the market is in a new territory that has not been observed before. It is essential to have some predictive and analytical ability even in times of a global pandemic as smart investments are crucial for securing the savings for people. Due to the recent nature of this crisis, there is limited research in tapping predictive power of market sentiment when a lot of people are deprived from extracurricular activities and thus have turned their focus in capital markets. This research finds that there is evidence of market sentiment influencing stock prices. Adding market sentiment to the classification improved the prediction power of the model as compared to just price and trend information. This shows that sentiment analysis can be used to make investment strategies as it has influence over the price movements in the stock market. This research also finds that looking at the sentiment of posts up to one hour into the past yields the best predictive abilities in price movements

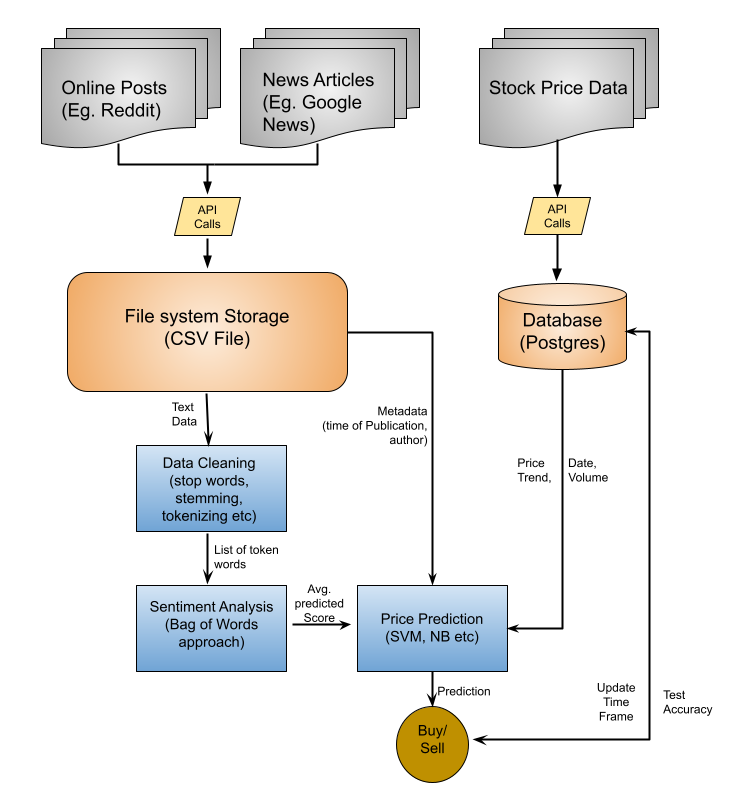

Figure 1. Software Architecture DiagramLink to Paper: Paper

Link to Source Code: GitLab

Link to Demonstration Video: YouTube

Link to Poster: Poster